PRODUCT LIABILITY INSURANCE

Product Liability insurance provides coverage for claims against manufacturers and sellers of products to the general public like tires, power sports, tools, dietary supplements and other goods.

What is Product Liability Insurance?

Product Liability insurance provides coverage for claims against manufacturers and sellers of products to the general public like tires, power sports, tools, dietary supplements and other goods. It offers protection to manufacturers or sellers for losses or injuries to a user or bystander caused by a defect or

malfunction of the product, and, in some instances, defects in the product’s design or inadequate warning labels. When it is part of a Commercial General Liability policy, coverage is often referred to as Products-Completed Operations insurance. Below are the most common scenarios that can result in a Product Liability claim.

When steps taken or not taken during the production process result in an unreasonably unsafe defect

in the resulting product. EXAMPLE: An assembly line worker forgets to tighten a nut or bolt that causes the product to fail, resulting in bodily injury to the user.

When steps taken or not taken during the production process result in an unreasonably unsafe defect

in the resulting product. EXAMPLE: An assembly line worker forgets to tighten a nut or bolt that causes the product to fail, resulting in bodily injury to the user.

When steps taken or not taken during the production process result in an unreasonably unsafe defect

in the resulting product. EXAMPLE: An assembly line worker forgets to tighten a nut or bolt that causes the product to fail, resulting in bodily injury to the user.

Why your company may need product liability insurance?

If your company manufactures any kind of product, from tires to engines, computers to clothing, it could easily find itself on the wrong side of a lawsuit by a plaintiff claiming your product(s) caused some kind of injury or damage. In today’s litigious society, it is not even necessary for you to be the manufacturer of the product. Sellers are often sued alongside the manufacturers

Product liability exposure lasts as long as the product is in use Someone may be injured or damage may result from use of the product years after it was manufactured and the product may no longer be in production. Product liability insurance should be kept in force as long as the products are being used and could cause injury or damage. Because of the continued liability exposure, insurers require insureds to provide detailed information about discontinued products.

The basic premise of most product liability lawsuits is that the product manufacturer or vendor failed to täke appropriate steps to insure the product was safe and sound. It is impossible to eliminate all hazards in connection with many products. No matter what you do, someone could fall off a ladder or burn themselves with a hair dryer, and so forth. To show that you did everything possible to prevent such injuries, it is critically important to communicate with buyers and users of the product about such hazards. The thing to remember is that if there is a lawsuit, your best defense is to prove you took all reasonable measures to assure no one would be injured.

What Product Liability Insurance Covers

Bodily Injury

In the event that somebody is injured by your product, product liability insurance can cover the cost of care, lost wages, restitution for wrongful death, or legal fees (if you’re taken to court.)

Property Damage

In the event that property is damaged due to your product, product liability insurance can cover the value of physical damage, repairs, lost profit due to damages, and legal fees (if you’re taken to court.)

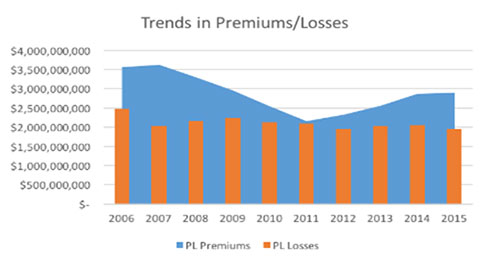

Trends in Product Liability

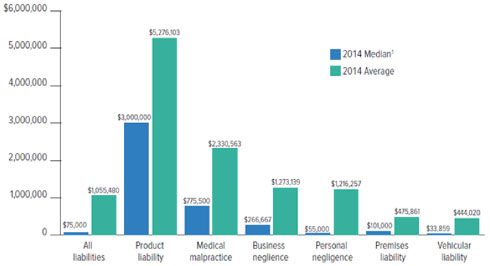

2014 Mean and Median Jury Awards for Product Liability

- With e-commerce, exposures are becoming more global. This means higher rates of multi-jurisdictional cases, and more class action lawsuits

- Non-U.S. litigants are increasingly filing suit in U.s. courts as the reputation for high payouts in the U.S. entices litigants abroad.

- U.S. defendants face new challenges, including cross-border discovery and parallel proceedings in U.S. and foreign courts.

- Courts are becoming less agreeable to allowing plaintiffs to choose the jurisdiction in which they wish to bring suit.

- Overall frequency of product liability claims have steadily risen over the past 30 years, and the payouts of judgements has gotten larger, with payouts

- U.S. courts are becoming more willing to allow class action suits, even if the majority of product owners have not suffered a loss.

- States are enacting “statutes of repose” to limit the time frame for a plaintiff to bring a product liability suit but the statute may be extended by the court on

Source: Thomas Reuters, Current Award Trends in Personal Injury, 54th edition.

Mean: The sum of all jury award for the divided by the number od cases in the same year

Median: The Middle number. in a lisr from lowest to higest

Source: Statistical Compilation of Annual Statement information

Get a full quote for your product

Your Product liability experts in the tire and motorsports industries